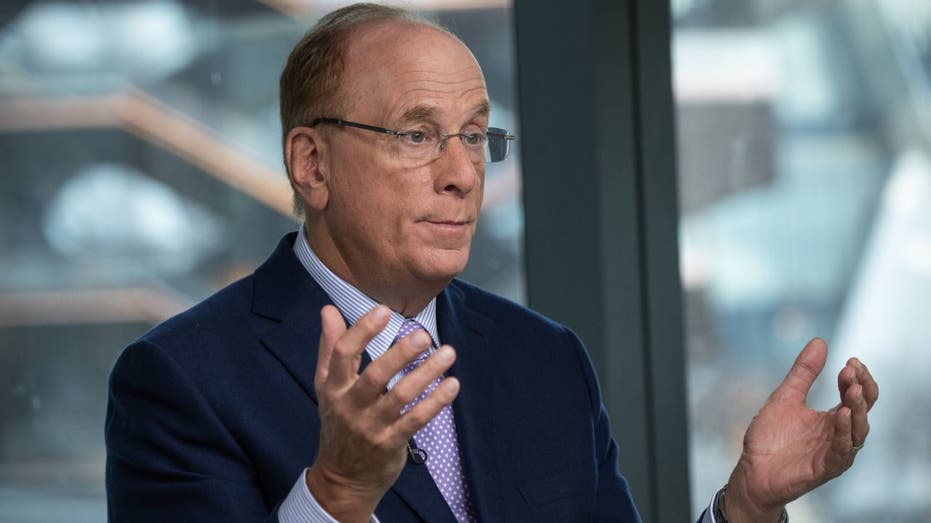

The president and CEO of Blackrock, Larry Fink, gives his opinion on the negotiations tariffs with China and the volatility of the market in ‘The Clarman Countdown’.

The 60/40 portfolio, the bond actions, has long been the proven and true method for those who build their retirement eggs with a diversification safety network. But the times are changing and the Blackrock CEO, Larry Fink, is advising an image change.

“Generations of investors have done it well after this approach, having a combination of the entire market instead of individual values. But as the global financial system continues to evolve, the 60/40 classic portfolio can no longer complete Private, “Fewred in his 2025 letters.

The annual letter of the Blackrock Larry Fink CEO to investors

Larry Fink, president and executive director of Blackrock Inc., on the right, and Adebayo Ogunlesi, president and executive director of Global Infrastructure Partners (GIP), during a television interview by Bloomberg in New York, USA. UU., On Friday, January 12. (Photographer: Victor J. Blue / Bloomberg through Getty Images / Getty Images)

In the case of infrastructure, Fink promoted its inflation protection characteristic; Income generation from payments, stability versus volatile public markets and solid yields even with only 10% of the allocation, he said.

Blackrock recently paid $ 23 billion for the ports of the Panama Canal. As an example, income can be generated by charging boat rates to pass through the river tracks.

Blackrock pays $ 23 billion for the ports of the Panama Canal

| Heart | Security | Last | Change | Change % |

|---|---|---|---|---|

| Bisquematado | Blackrock Inc. | 875.75 | +9.64 | +1.11% |

Although Blackrock, with more than $ 11 billion in assets is the largest asset manager in the world, a 50/30/20 mixture or other division with alternative assets, may make sense for smaller retail investors.

“For someone who has a long time ahead and has the assets to justify an allocation to the private ones, we believe it is a really exciting opportunity due to the diversification it provides to a portfolio,” Katie KlingensmithEdelman Financial Engines Strata Investment Head, he told Fox Business.

Mortgage rates in the midst of market volatility

“From our perspective in general, when we think about building those really robust portfolios for our clients, but when we also think about what we believe is better for most investors that are not necessarily ultra high of net value. Private markets have some really interesting characteristics, and it will be quite exciting to see how they respond to this period at this time of public instability of the market,” he added.

The S&P 500, the widest measure of the US stock market, has lost 10% this year.

Get the Fox business on the fly by clicking here

The Morningstar core bond index in the US increases approximately 2% this year. It measures the values called US dollars with a fixed rate, of investment level, with maturities of more than a year, according to the firm.